Mercoledì 2 aprile, il presidente Trump ha annunciato un'ampia espansione delle tariffe da applicare a 185 paesi e territori. In precedenza, erano state annunciate nuove tariffe da applicare a Cina, Canada e Messico, nonché tariffe settoriali specifiche su alluminio, acciaio e automobili. In questa spiegazione, tratteremo cosa è cambiato nella politica commerciale e nelle tariffe degli Stati Uniti nel 2025, come e quando verranno applicate tali modifiche, cosa è coperto e cosa significa per le aziende.

Quali sono gli obiettivi dei cambiamenti nella politica commerciale?

I dazi su Messico e Canada sono stati introdotti con l'obiettivo di fare pressione sui vicini degli Stati Uniti affinché facciano di più per affrontare il presunto contrabbando di fentanyl e l'immigrazione illegale, nonché per proteggere l'industria nazionale. L'obiettivo dichiarato delle tariffe reciproche, secondo l'Ufficio del Rappresentante per il Commercio degli Stati Uniti , è "bilanciare i deficit commerciali bilaterali tra gli Stati Uniti e ciascuno dei nostri partner commerciali".

Cosa significa per le aziende

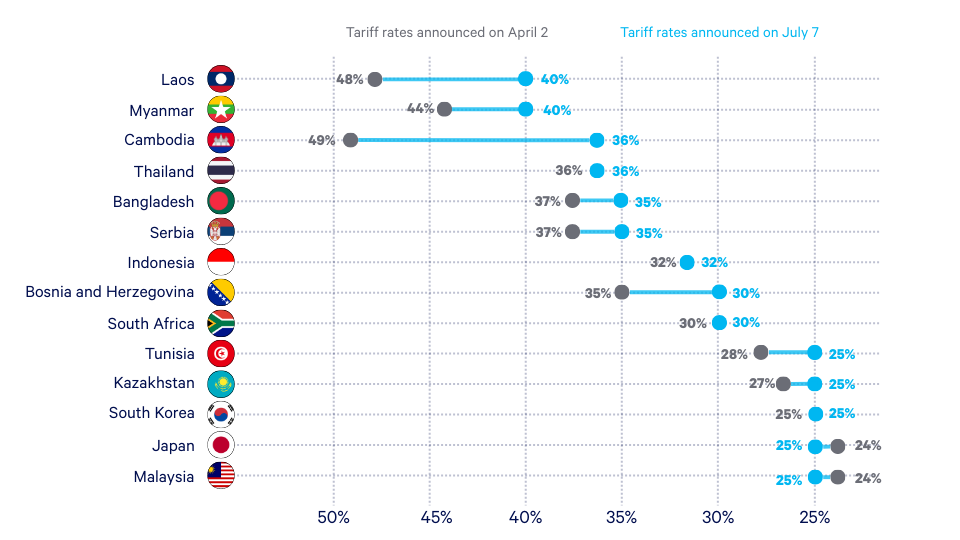

Le tariffe sono state ampiamente rinegoziate, le tariffe "reciproche" sono cambiate e le scadenze sono state prorogate per consentire il proseguimento delle discussioni. Questa incertezza ha messo le catene di approvvigionamento in un dilemma: come adattarsi all'ignoto? E questa incognita non è un cambiamento futuro lontano che non può essere previsto, ma un'incognita relativamente a breve termine e di grande impatto che lascia i leader della supply chain a chiedersi: quanto costerà produrre, spostare e vendere i nostri prodotti tra pochi mesi o tra poche settimane? Quali nazioni e fornitori sono nella posizione migliore per soddisfare le nostre esigenze in un nuovo mondo di commercio influenzato dai dazi?

I timori comuni per le catene di approvvigionamento sono l'aumento del costo delle merci vendute (COGS), la riduzione dei margini, gli ordini già impegnati e l'inventario che diventa non redditizio e la preoccupazione che gli aumenti dei prezzi determinino un cambiamento del comportamento dei consumatori e una riduzione della domanda.

È probabile che i produttori e i fornitori spingano l'aumento dei costi sugli utenti finali e che anche i marchi di vendita al dettaglio aumentino i prezzi per proteggere i margini.

Come puoi reagire?

Un'interruzione di questa portata e velocità è impegnativa nelle migliori circostanze, ma molte organizzazioni della supply chain sono ancora alle prese con un processo decisionale lento, una pianificazione manuale degli scenari e una visione limitata dei loro partner commerciali.

Le implicazioni del cambiamento delle politiche commerciali sono potenzialmente enormi e richiedono che i leader della supply chain siano in grado di collaborare in modo efficace tra le funzioni e con i partner, cosa che non è possibile fare quando i dati sono isolati, lenti da aggiornare e da comunicare.

Per creare un playbook per gestire questo tipo di incertezza e interruzione in modo rapido e su larga scala, è necessario che i responsabili della supply chain siano in grado di vedere in tempo reale cosa sta succedendo nella loro rete. Devono essere in grado di vedere cosa sta succedendo non solo nella loro attività, ma anche nei loro partner commerciali.

Collegare queste aziende in una rete di supply chain digitale come la Blue Yonder Network non si limita a consentire una migliore pianificazione degli scenari e risposte più agili a cambiamenti importanti come l'imposizione delle tariffe. Inoltre, aiuta le supply chain a reagire rapidamente a qualsiasi tipo di interruzione, aiutando i leader a vedere i problemi man mano che si sviluppano piuttosto che una volta che i loro effetti a valle si fanno sentire, e consentendo loro di apportare i tipi di adattamenti e cambiamenti al volo richiesti da una vera pianificazione degli scenari.